Scientific forex The Truth Behind Commonly Used Indicators

Página 1 de 1.

Scientific forex The Truth Behind Commonly Used Indicators

Scientific forex The Truth Behind Commonly Used Indicators

Scientific forex The Truth Behind Commonly Used Indicators

The Truth Behind Commonly Used Indicators

By Cristina Ciurea

ScientificForex.com

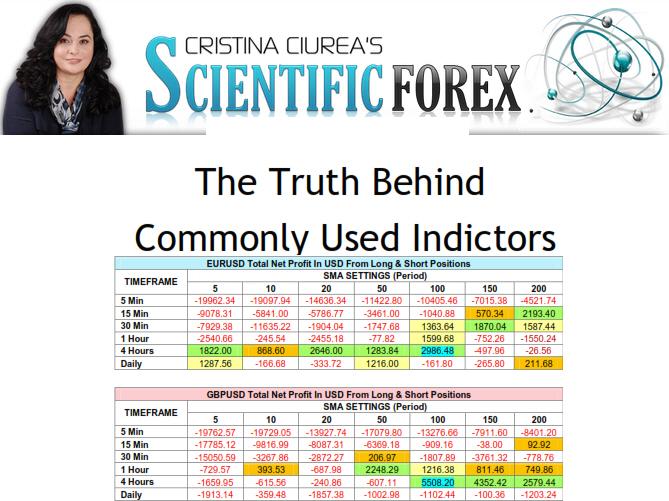

By Author : In order to see if the settings really worked from a scientific point of view, I back-tested the indicators with different settings on a couple of currency pairs and across a variety of timeframes.

To ensure enough trades are entered for reliable results, I ran all back-tests through 4 years of historical data (January 2008 to December 2011). Using similar entry, stop loss and take profit rules for each test, I started out with a $10,000 account and set each trade to be entered at 0.1 lot to allow enough equity for the trades. The spread for EURUSD and GBPUSD is 2 pips.

The rules of the tests are simple.

1. Enter at the close of the candle right after the signal appeared. The signal depends on the indicator or candlestick reversal pattern that is used.

2. Set the stop loss 3 pips above the highest high of the past three candles.

3. Set the take profit twice the value of the stop loss.

The answers to the questions listed in the previous page will be based on some vital data from the results of the backtests. Here’s what we are looking for:

1. Total net profit – Of course, the best measure of performance is the total profit you get from the trades entered. What good is an indicator if it does not help you earn a profit?

2. Percentage of Profit Trades – This indicates the percentage of winning trades from the total number of trades entered. The higher the percentage, the more winners and the better is the performance.

3. Drawdown – It is the difference from highest and lowest balance of the account, in percentage. The lower the drawdown, the more stable are the gains and the better is the performance.

Contents :

INTRODUCTION

METHODOLOGY

MOVING AVERAGES

I. Signal/Entry Trigger

II. Settings

III. Simple Moving Average (SMA) Findings

IV. Exponential Moving Average (EMA) Findings

V. SMA versus EMA

STOCHASTIC OSCILLATOR

I. Signal/Entry Trigger

II. Settings

III. Findings

RELATIVE STRENGHT INDEX (RSI)

I. Entry trigger

II. Settings Tested

III. Findings

CANDLESTICK REVERSAL PATTERNS

I. Dark Cloud Cover

II. Engulfing Pattern

III. Hammer & Hanging Man

IV. Inverted Hammer & Shooting Star

APPLICATION

I. Improving Your Profitability

II. Examples

Bajar:

[Tienes que estar registrado y conectado para ver este vínculo]

The Truth Behind Commonly Used Indicators

By Cristina Ciurea

ScientificForex.com

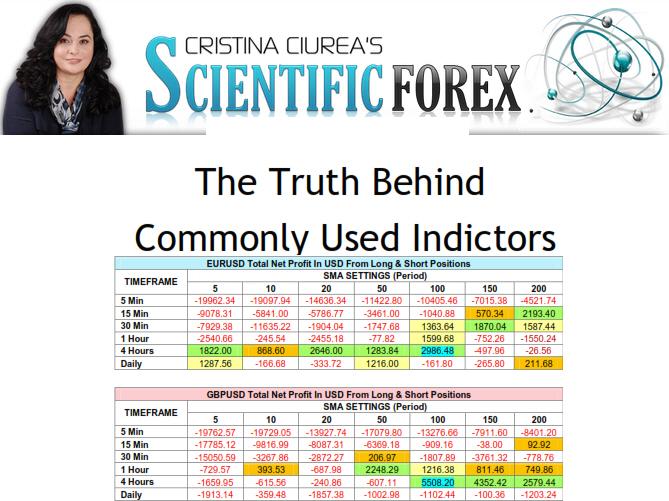

By Author : In order to see if the settings really worked from a scientific point of view, I back-tested the indicators with different settings on a couple of currency pairs and across a variety of timeframes.

To ensure enough trades are entered for reliable results, I ran all back-tests through 4 years of historical data (January 2008 to December 2011). Using similar entry, stop loss and take profit rules for each test, I started out with a $10,000 account and set each trade to be entered at 0.1 lot to allow enough equity for the trades. The spread for EURUSD and GBPUSD is 2 pips.

The rules of the tests are simple.

1. Enter at the close of the candle right after the signal appeared. The signal depends on the indicator or candlestick reversal pattern that is used.

2. Set the stop loss 3 pips above the highest high of the past three candles.

3. Set the take profit twice the value of the stop loss.

The answers to the questions listed in the previous page will be based on some vital data from the results of the backtests. Here’s what we are looking for:

1. Total net profit – Of course, the best measure of performance is the total profit you get from the trades entered. What good is an indicator if it does not help you earn a profit?

2. Percentage of Profit Trades – This indicates the percentage of winning trades from the total number of trades entered. The higher the percentage, the more winners and the better is the performance.

3. Drawdown – It is the difference from highest and lowest balance of the account, in percentage. The lower the drawdown, the more stable are the gains and the better is the performance.

Contents :

INTRODUCTION

METHODOLOGY

MOVING AVERAGES

I. Signal/Entry Trigger

II. Settings

III. Simple Moving Average (SMA) Findings

IV. Exponential Moving Average (EMA) Findings

V. SMA versus EMA

STOCHASTIC OSCILLATOR

I. Signal/Entry Trigger

II. Settings

III. Findings

RELATIVE STRENGHT INDEX (RSI)

I. Entry trigger

II. Settings Tested

III. Findings

CANDLESTICK REVERSAL PATTERNS

I. Dark Cloud Cover

II. Engulfing Pattern

III. Hammer & Hanging Man

IV. Inverted Hammer & Shooting Star

APPLICATION

I. Improving Your Profitability

II. Examples

Bajar:

[Tienes que estar registrado y conectado para ver este vínculo]

Temas similares

Temas similares» Naked Forex- Trading without indicators

» Christina Scientific Forex method

» FREE FOREX INDICATORS

» Logical Forex Indicators

» FOREX-TSD Elite indicators

» Christina Scientific Forex method

» FREE FOREX INDICATORS

» Logical Forex Indicators

» FOREX-TSD Elite indicators

Página 1 de 1.

Permisos de este foro:

No puedes responder a temas en este foro.